We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

PwC partner banned over BHS audit

Image source, Getty Images

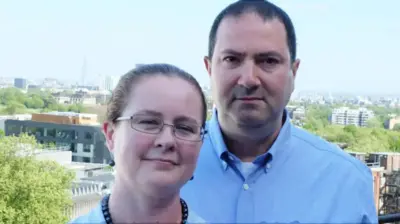

The partner at PwC who signed off on the accounts of BHS has been banned from the profession for 15 years.

Steve Denison admitted misconduct over the 2014 audit of BHS and the Taveta Group, which controls Topshop.

In 2015 Mr Denison signed off the BHS accounts as a going concern, just days before it was sold for ¬Θ1.

BHS collapsed in 2016 with the loss of 11,000 jobs and a pension deficit of ¬Θ571m.

As well as banning Mr Denison, the Financial Reporting Council (FRC) fined him ¬Θ325,000 and PwC ¬Θ6.5m.

The FRC said both had admitted "misconduct".

'Sorry'

PwC said there were "serious shortcomings with this audit work".

"We are sorry that our work fell well below the professional standards expected of us and that we demand of ourselves," the company said.

"At its core this is not a failure in our audit methodology, the methodology simply was not followed."

It said that the audit failings "did not contribute to the collapse of BHS".

PwC added that it had overhauled its monitoring procedures.

Mr Denison left the audit firm this month after nearly 33 years there.

Serial bankrupt

The failure of BHS was the biggest collapse in the British retail industry since the demise of Woolworths in 2008.

It prompted intense scrutiny. Politicians investigated how Sir Philip Green had been able to sell the business, with a large pension deficit, to a company run by Dominic Chappell, a serial bankrupt with no retail experience.

BHS's pension deficit had ballooned to ¬Θ571m by the time the retailer went into administration in April 2016.

Last year, Sir Philip paid ¬Θ363m to BHS's pension schemes.

Top Stories

More to explore

Most read

Content is not available